Car Loan EMI Calculator ICICI

Calculate your monthly car loan payments with ICICI Bank

ICICI Car Loan Interest Rate: 9.20% – 10.20% p.a.

ICICI Max Car Loan Tenure: 7 years

This calculator provides an estimate of your car loan EMI. Actual terms may vary based on ICICI Bank’s current policies and your credit profile.

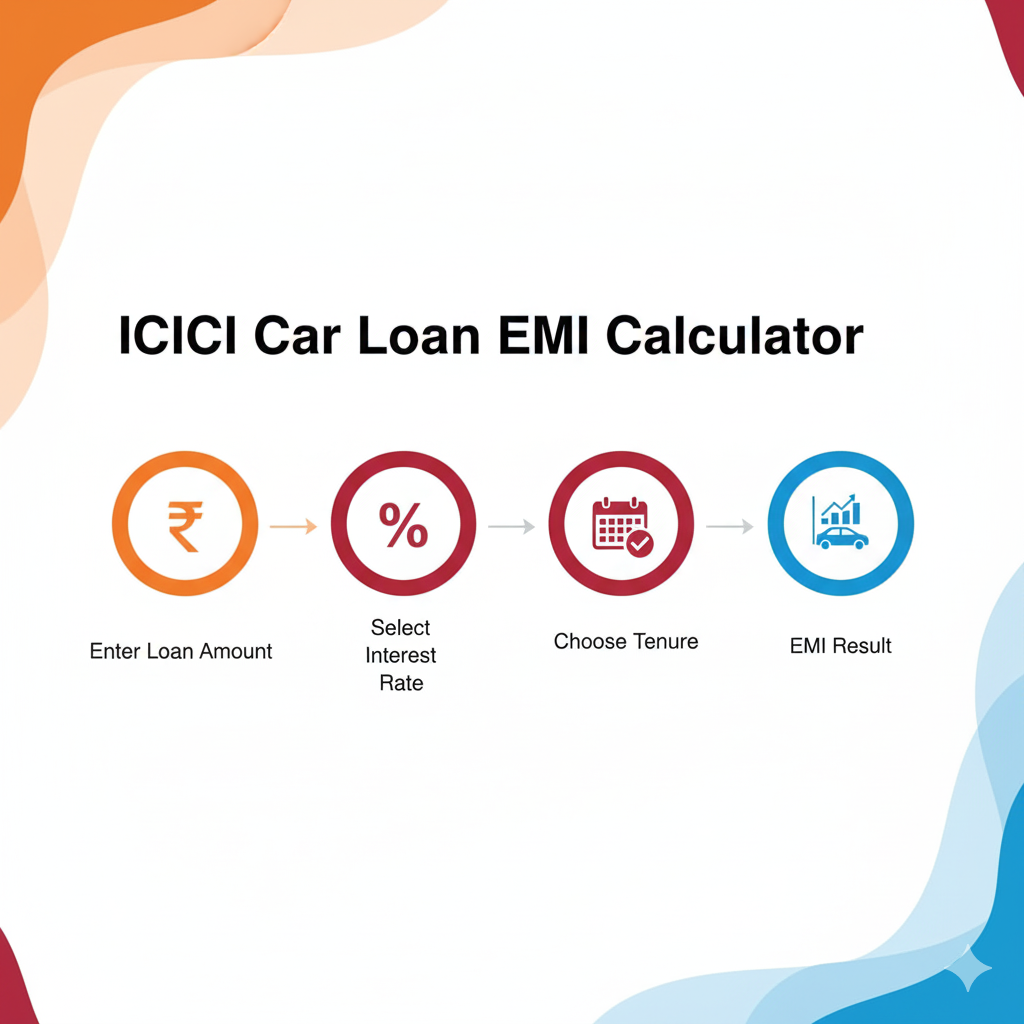

What is Car Loan EMI Calculator ICICI

The ICICI Bank Car Loan EMI Calculator is essentially an online tool designed to help people quickly determine their monthly payments if they’re borrowing from ICICI Bank to buy a car. It takes three main pieces of information: the amount you’re borrowing, the interest rate, and how long you want to take to pay it back. Once you input those, it spits out the precise EMI, plus a split between what’s going toward the principal and what’s for interest.

This setup keeps everything straightforward and clear when it comes to repaying the loan. Rather than sitting down with a calculator and doing the math yourself, you can use this to check if it fits your budget and organize your money matters before signing on the dotted line. Whether you’re a first-time buyer or someone thinking about switching loans, it’s a solid way to make choices that actually make sense.

Eligibility, Importance, and Benefits

Eligibility for Car Loan EMI Calculator ICICI

ICICI Bank has some straightforward rules for who can apply:

- Age: You need to be between 21 and 70 years old.

- Employment: Whether you’re working a regular job or running your own business, you need a reliable income.

- Credit Score: They typically look for a CIBIL score of 700 or higher.

- Income Proof: The minimum income needed can change depending on where you live and the kind of loan.

Why EMI Calculation Matters

Getting a sense of your EMI before you apply for a car loan can really pay off in a few key areas:

- It stops you from taking on more debt than you can comfortably pay back.

- You can try out different repayment periods to see what works best.

- It gives you an edge when talking terms with the bank.

- Overall, it takes the uncertainty out of the equation and lets you relax a bit.

Key Benefits

There are some real advantages to using this:

- Quick Estimates: You get the numbers in just a few seconds.

- Accurate Planning: It makes sure your EMIs align with what you can afford monthly.

- Loan Comparison: Tweak the details to weigh up various options side by side.

- Informed Decision-Making: It helps you pick the right length of time and initial payment amount.

Formula and Calculation Method

Just like other banks, ICICI uses the tried-and-true EMI formula:

EMI = [P × r × (1 + r)^n] / [(1 + r)^n – 1]

Where:

- P stands for the principal, which is the amount you borrowed.

- r is the interest rate per month (take the yearly rate, divide by 12, then by 100).

- n is how many months the loan will run for.

This approach keeps your payments even throughout. At the start, more of your EMI goes to interest, but as time goes on, you’re chipping away more at the principal until it’s all paid off.

Examples with Explanation

To get a better feel for how the ICICI car loan EMI calculator operates, here are some real-life scenarios.

Example 1 – Compact Car Loan

- Loan Amount: ₹4,00,000

- Interest Rate: 9% per annum

- Tenure: 5 years (60 months)

Plugging this in, your EMI comes to about ₹8,298 each month.

Example 2 – Sedan Loan

- Loan Amount: ₹8,00,000

- Interest Rate: 9.5% per annum

- Tenure: 6 years (72 months)

This setup gives an EMI of roughly ₹14,880 per month.

Example 3 – Premium SUV Loan

- Loan Amount: ₹15,00,000

- Interest Rate: 10% per annum

- Tenure: 7 years (84 months)

Here, you’d be looking at approximately ₹24,908 monthly.

These show just how much a tweak in the borrowed amount or the rate can shift your ongoing payments.

Maximum Limit or Legal Rules For Car Loan EMI Calculator ICICI

ICICI Bank handles a variety of car loan sizes, but they do have boundaries:

- Loan Amount: Generally covers 80–90% of what the car costs on the road.

- Minimum Loan: Starts at about ₹1 lakh.

- Maximum Loan: Can reach up to ₹50 lakhs for fancier models.

- Tenure: Anywhere from 1 to 7 years.

Legal Aspects

The vehicle gets hypothecated to ICICI Bank, meaning they have a claim on it until you’ve paid everything back.

If you slip up on payments or default, you could face fees or even lose the car.

All of this follows RBI rules to keep things fair and above board.

Online Car Loan EMI Calculator ICICI Benefits

Using the online ICICI Car Loan EMI Calculator comes with some definite pluses:

- Saves Time: You get answers right away, without any hand calculations.

- Accuracy: It minimizes mistakes that could happen otherwise.

- Scenario Testing: Experiment with different amounts, lengths, or rates to watch the EMIs change.

- Transparency: Puts you in the driver’s seat before you agree to anything.

- Accessible Anywhere: It’s right there on their site or app, whenever you need it.

Private vs Government / Variations

ICICI is a private bank, but it stacks up against both private and public ones.

Private Banks (such as ICICI or HDFC): They move quickly, offer lots of personalization, and focus on digital services, though rates might be a touch higher.

Government Banks (like SBI or PNB): They have attractive rates, but approvals can drag on with extra documentation.

If speed and ease are your priorities, something like ICICI often wins out.

Taxation Rules

For most folks, car loans don’t bring tax advantages.

Personal Car Loan: You can’t deduct the EMI or interest from your taxes.

Business Car Loan: The interest part might count as a business cost, helping lower what you owe in taxes.

So, without a business angle, there’s no tax break to soften the blow.

Factors Influencing ICICI Car Loan EMI

A few things can sway what your EMI looks like:

- Loan Amount: Borrow more, and your monthly hit goes up.

- Interest Rate: A half-percent shift can add up noticeably.

- Tenure: Stretching it out lowers the EMI but ramps up the total interest.

- Credit Score: Strong credit can snag you a better rate.

- Down Payment: Shelling out more at the start eases the EMI load.

Myths vs Reality

Myth 1: A smaller EMI equals a better deal. Reality: It might just mean a longer payback period, where interest piles up more.

Myth 2: The Car Loan EMI Calculator ICICI is just a rough guess. Reality: It’s pretty spot-on; it only leaves out small extras like fees for processing.

Myth 3: Your income is the only thing that decides if you can afford the EMI. Reality: They also factor in your age, credit background, and how you’ve handled payments before.

Sample Car Loan EMI Calculator ICICI Table

Here’s a handy table for ICICI car loans across various amounts and terms:

| Loan Amount | Tenure (Months) | Interest Rate | Approx EMI |

|---|---|---|---|

| ₹3,00,000 | 36 | 9% | ₹9,542 |

| ₹5,00,000 | 60 | 9.5% | ₹10,497 |

| ₹8,00,000 | 72 | 10% | ₹14,850 |

| ₹12,00,000 | 84 | 10% | ₹19,909 |

| ₹15,00,000 | 84 | 10% | ₹24,886 |

This table makes it easy to see how loan scale affects your commitments.

FAQs On Car Loan EMI Calculator ICICI

Conclusion For Car Loan EMI Calculator ICICI

The Car Loan EMI Calculator ICICI goes beyond simple math; it’s like a trusty sidekick for managing your finances wisely. It lays out your monthly duties clearly, cutting through the fog so you can decide with confidence.

Thanks to ICICI’s solid loan options, adaptable terms, and tech-savvy vibe, getting behind the wheel of your ideal car doesn’t have to be overwhelming. From a small city car to a high-end SUV, this calculator keeps payments steady, doable, and right in line with your spending plan.

In the end, the wisest people borrowing are those who think ahead. Using the ICICI car loan EMI calculator lets you savor owning a car while safeguarding your money situation.