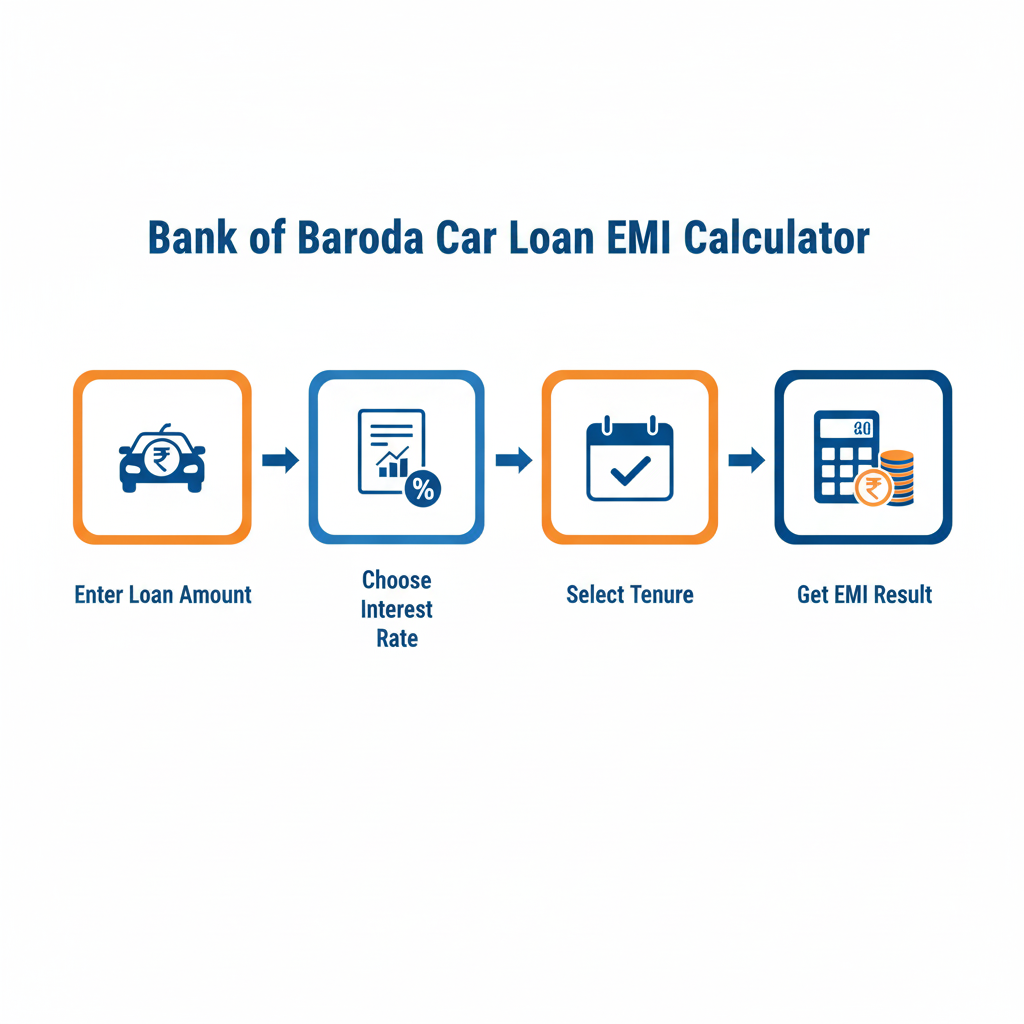

Bank of Baroda Car Loan EMI Calculator

Calculate your monthly car loan payments with Bank of Baroda

Bank of Baroda Car Loan Interest Rate: 8.70% – 10.20% p.a.

Bank of Baroda Max Car Loan Tenure: 7 years

This calculator provides an estimate of your car loan EMI. Actual terms may vary based on Bank of Baroda’s current policies and your credit profile.

What is Bank of Baroda Car Loan EMI Calculator

When you’re thinking about buying a new or used car, one of the main worries for a lot of folks is figuring out how to handle those monthly payments. That’s where the Bank of Baroda Car Loan EMI Calculator comes in—it’s an online tool that takes away all the uncertainty. You just need to input three things: how much you’re borrowing, the interest rate, and how long the loan will last, and it tells you right away what your Equated Monthly Installments (EMIs) will be.

This is particularly helpful for people getting their first car or those looking to move up to something larger. Beyond just giving you the EMI figure, it breaks down how much is going toward paying back the loan itself and how much covers the interest. It’s straightforward, quick, and really geared toward helping you make wiser choices about your money before you lock into a loan.

Eligibility, Importance, and Benefits

Eligibility for Bank of Baroda Car Loan EMI Calculator

Bank of Baroda makes car loans available to people with regular jobs as well as those who work for themselves, but there are some standard requirements to meet:

- Age: You have to be at least 21 when you apply, and no older than 70 by the time the loan wraps up.

- Income: You’ll need to show you have a reliable way to earn money to prove you can pay it back.

- Credit Score: A good CIBIL score, ideally 700 or above, really boosts your chances of getting approved.

- Employment Status: If you’re salaried, they want to see a steady work history; for business owners, consistent profits are key.

Importance of Calculating EMIs

Getting a clear picture of your EMI commitments before you apply means you won’t take on more than you can handle. Skipping this step could lead to some real money troubles down the road.

The EMI calculator lets you:

- Gauge what you can actually afford.

- Try out various lengths of time and loan sizes for comparison.

- Steer clear of any shocks by knowing your payment schedule upfront.

Benefits of Using Bank of Baroda Car Loan EMI Calculator

There are some solid perks to this tool:

- Accuracy: It delivers spot-on results based on the right math.

- Convenience: You can access it online anytime, and it’s completely free.

- Budgeting: It aids in organizing your monthly spending more effectively.

- Comparison: You get to experiment with different rates and time frames to see what fits best.

Formula and Calculation Method

Bank of Baroda uses the same EMI formula that you’ll find at other banks:

EMI = [P × r × (1 + r)^n] / [(1 + r)^n – 1]

Where:

- P is the loan principal, or the amount you actually borrowed.

- r is the interest rate per month (that’s the yearly rate divided by 12 and then by 100).

- n is how many months the loan will run for.

This setup keeps your EMIs steady all through the loan period, even though the mix of principal and interest shifts as you go along.

Examples with Explanation

To get a better sense of how the calculator functions, here are a few examples:

Example 1 – Compact Car Loan

- Loan Amount: ₹5,00,000

- Interest Rate: 8.75% per annum

- Tenure: 60 months

EMI: Around ₹10,326 each month.

Example 2 – Mid-Range Sedan Loan

- Loan Amount: ₹10,00,000

- Interest Rate: 9% per annum

- Tenure: 72 months

EMI: Approximately ₹18,062 per month.

Example 3 – SUV Loan

- Loan Amount: ₹15,00,000

- Interest Rate: 9.25% per annum

- Tenure: 84 months

EMI: About ₹24,251 monthly.

These show how the rate and length of the loan can affect your payments. Opting for more time to pay lowers the monthly amount but means you’ll shell out more in interest overall.

Maximum Limit or Legal Rules For Bank of Baroda Car Loan EMI Calculator

In general, Bank of Baroda’s car loan setup allows for:

- Minimum Loan Amount: ₹1 lakh.

- Maximum Loan Amount: Up to 90% of what the car costs on the road.

- Tenure: Starting from 12 months and going up to 84 months.

Legal Rules to Note

The car stays hypothecated to the bank, meaning they have a claim on it until you’ve paid everything off.

They follow RBI rules to keep all fees and processes clear.

You’ll face penalties if you miss payments or try to pay off early during any restricted period.

Online Bank of Baroda Car Loan EMI Calculator Benefits

Turning to the Bank of Baroda Car Loan EMI Calculator online brings a lot of good points:

- Instant Calculation: You see the numbers pop up in no time.

- Customization: Adjust the loan size and duration to match what you can handle.

- Transparency: It’s all straightforward, with no sneaky fees—just plain EMI info.

- Accessibility: It runs smoothly on phones or computers.

- Confidence: You can head into applying for the loan knowing exactly what to expect in repayments.

Private vs Government Bank Variations

Bank of Baroda being a public sector bank, it’s useful to see how it compares to private ones to get the full picture:

Government Banks (like Bank of Baroda):

- They offer lower interest rates.

- Fees are straightforward and clear.

- Processing might take a bit longer because of the procedures.

- They cover more ground in rural and smaller urban spots.

Private Banks (such as ICICI, HDFC, Axis):

- Approvals and getting the money happen quicker.

- There’s more room to tweak the loan details.

- Rates tend to be a little higher.

- They push more promotional deals.

If you’re after smaller EMIs and steady reliability over time, public banks like this one often come out on top.

Taxation Rules For Bank of Baroda Car Loan EMI Calculator

Whether you get tax perks depends on what you’re using the car for:

Personal Use Car Loan: No breaks on taxes for the EMI or interest.

Business Use Car Loan: You can count the interest as a work expense, which cuts down on your taxes.

So, regular employees might not see any tax relief, but those running their own show or self-employed can benefit.

Factors Influencing Bank of Baroda Car Loan EMI

A number of things can affect what your EMI turns out to be:

- Loan Amount: More borrowing equals a bigger EMI.

- Interest Rate: A quarter-percent difference can really change the total payback.

- Tenure: More months mean smaller EMIs but more interest paid in the end.

- Credit Score: Higher scores can get you better rates.

- Down Payment: Putting more down at the start eases up the EMI.

- Car Type: Brand-new cars might come with nicer terms than pre-owned ones.

Myths vs Reality On Bank of Baroda Car Loan EMI Calculator

Myth 1: Government banks sneak in extra fees. Reality: Places like Bank of Baroda are tightly controlled and keep everything out in the open.

Myth 2: EMI tools are just for rough ideas. Reality: They’re precise because they use the actual formulas from the bank.

Myth 3: Car loans are only for people with steady paychecks. Reality: Under Bank of Baroda’s rules, self-employed folks, business people, and even farmers could qualify.

Sample Bank of Baroda Car Loan EMI Calculator Table

Here’s a table with some examples from the Bank of Baroda Car Loan EMI Calculator:

| Loan Amount | Tenure (Months) | Interest Rate | Approx EMI |

|---|---|---|---|

| ₹3,00,000 | 36 | 8.75% | ₹9,507 |

| ₹6,00,000 | 60 | 9% | ₹12,499 |

| ₹9,00,000 | 72 | 9.25% | ₹16,286 |

| ₹12,00,000 | 84 | 9.25% | ₹19,401 |

| ₹15,00,000 | 84 | 9.5% | ₹24,309 |

This table makes it clear how the length and rate can alter your monthly commitment.

FAQs On Bank of Baroda Car Loan EMI Calculator

Conclusion

The Bank of Baroda Car Loan EMI Calculator goes beyond being handy—it’s like a buddy for sorting out your finances. It gives borrowers real, useful info on what they’ll owe each month, so they can choose wisely before jumping into a car loan.

With Bank of Baroda’s reasonable rates, solid reputation, and clear-cut policies, it’s a smart option for newcomers and experienced borrowers alike. Whether it’s a compact car, a fancy SUV, or something second-hand, this tool makes sure you go in with your eyes wide open and feeling sure.

Using it helps you find that sweet spot between owning the car you’ve always wanted and keeping your money matters in check. In a time when planning your finances is so important, the Bank of Baroda Car Loan EMI Calculator is a trusty partner for anyone borrowing smartly.