Axis Bank Car Loan EMI Calculator

Calculate your monthly car loan payments with Axis Bank

Axis Bank Car Loan Interest Rate: 9.50% – 10.50% p.a.

Axis Bank Max Car Loan Tenure: 7 years

This calculator provides an estimate of your car loan EMI. Actual terms may vary based on Axis Bank’s current policies and your credit profile.

What is Axis Bank Car Loan EMI Calculator

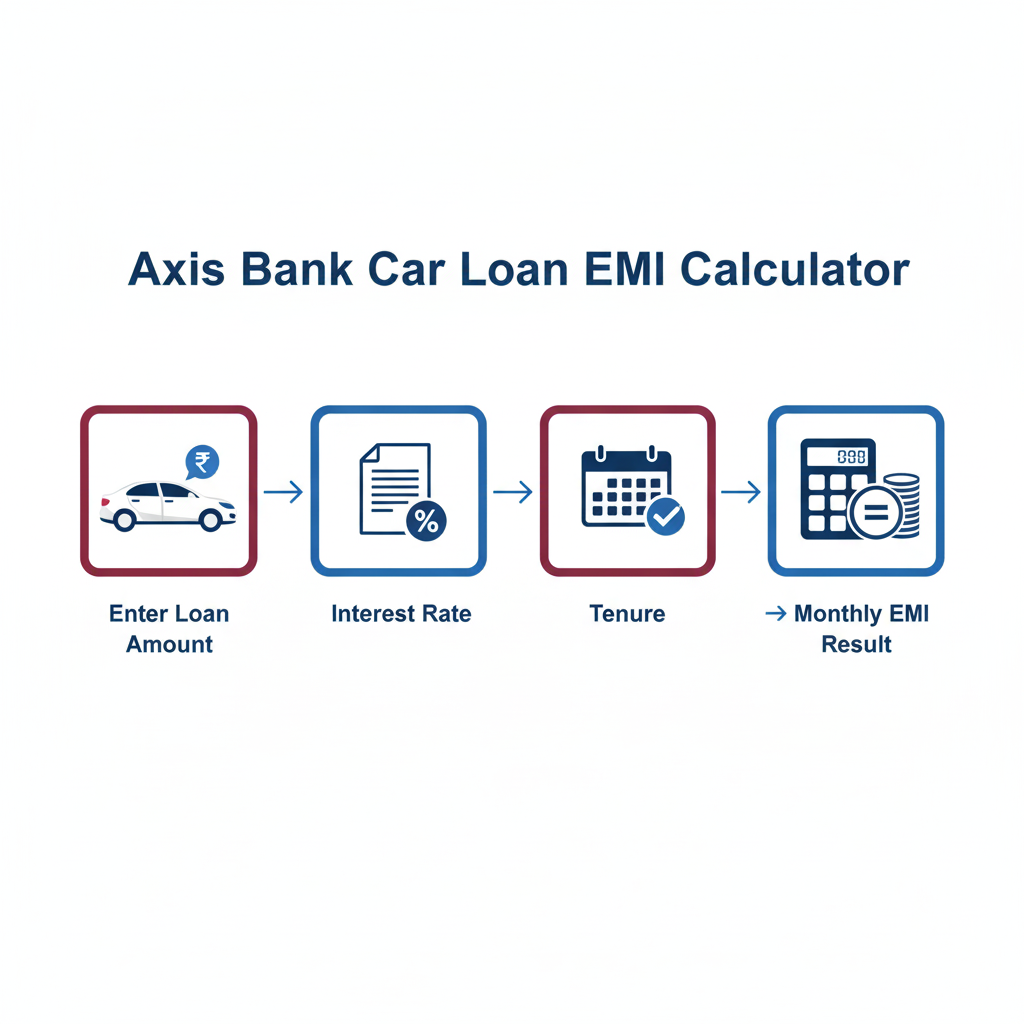

The Axis Bank Car Loan EMI Calculator is basically a handy online tool that makes figuring out your car loan repayments a lot easier. Getting a car is usually one of the major money decisions people make, right after buying a house, and trying to work out EMIs by hand can get pretty messy. With this calculator, you just pop in three basic details—the amount you’re borrowing, the interest rate, and how long you want the loan for—and it quickly tells you what your monthly payment will be.

But it doesn’t stop there; the Axis Bank Car Loan EMI Calculator breaks it down further, showing you how much of that monthly amount is paying off the actual loan and how much is going toward interest. This kind of openness really helps you get your head around things, manage your budget better, and steer clear of any money worries down the line. Whether you’re buying your very first car or thinking about trading up to something newer, this tool is a key piece in putting together your financial puzzle.

Eligibility, Importance, and Benefits

Eligibility for Axis Bank Car Loan EMI Calculator

Axis Bank opens up car loans to a pretty wide range of people, but there are some boxes you need to tick:

- Age: Typically between 21 and 70 years old.

- Income: You need a reliable income stream, whether from a job or your own business.

- Credit History: Having a solid credit score, around 700 or better, boosts your odds of getting approved.

- Employment Proof: They’ll want to see you’ve been working for a certain minimum time, depending on the loan specifics.

Importance of Axis Bank Car Loan EMI Calculator

If you skip calculating your EMIs upfront, you might end up biting off more than you can chew with your budget. The calculator shines a light on whether you can actually afford it before you commit to the loan papers.

It makes sure:

- You only take out what you know you can pay back.

- You get to weigh up various loan sizes and repayment periods.

- You dodge any fees for late payments by mapping out your repayments in advance.

Benefits of Using Axis Bank Car Loan EMI Calculator

There are some real upsides to this tool:

- Speed: You get answers almost instantly, in just seconds.

- Clarity: It lays out a clear schedule for how you’ll repay the loan.

- Control: You can tweak the loan amount and duration before you even apply.

- Decision-making: It makes it simple to stack up options from different banks or various loan setups.

Formula and Calculation Method

Axis Bank sticks with the standard formula everyone uses for EMIs:

EMI = [P × r × (1 + r)^n] / [(1 + r)^n – 1]

Where:

- P is the principal, meaning the main amount you borrowed.

- r is the interest rate each month (that’s the yearly rate divided by 12 and then by 100).

- n is the total months you’ll be paying over.

This method keeps your EMIs the same every month, though the split between interest and principal shifts as you go. In the beginning, more goes to interest, but later on, you’re mostly knocking down the principal.

Examples with Explanation

Let’s dive into a few situations to see how the Axis Bank Car Loan EMI Calculator plays out.

Example 1 – Small Hatchback Loan

- Loan Amount: ₹4,00,000

- Interest Rate: 9% per annum

- Tenure: 5 years (60 months)

EMI: Around ₹8,298 each month.

Example 2 – Mid-Range Sedan Loan

- Loan Amount: ₹8,00,000

- Interest Rate: 9.5% per annum

- Tenure: 6 years (72 months)

EMI: Approximately ₹14,880 per month.

Example 3 – Premium SUV Loan

- Loan Amount: ₹12,00,000

- Interest Rate: 10% per annum

- Tenure: 7 years (84 months)

EMI: About ₹19,926 monthly.

These scenarios illustrate how varying the length of the loan or the rate can change things up. Going for a bigger loan or more time to pay might ease the monthly squeeze, but it bumps up the overall cost because of extra interest.

Maximum Limit or Legal Rules

Axis Bank usually covers about 85–90% of what the car costs on the road, but that can depend on your qualifications and credit standing.

- Minimum Loan Amount: Starts at roughly ₹1 lakh.

- Maximum Loan Amount: Can climb to ₹50 lakhs for top-tier luxury vehicles.

- Tenure: Ranges from 1 to 7 years.

Legal Rules and Guidelines

The car stays hypothecated to Axis Bank, which means they hold a legal interest in it until you’ve cleared the loan.

Everything follows RBI rules to keep fees and processes clear and fair for borrowers.

If you default on an EMI, you could face extra charges or, in worse cases, they might take back the car.

Online Axis Bank Car Loan EMI Calculator Benefits

The Axis Bank Car Loan EMI Calculator comes with a bunch of clear perks:

- User-Friendly: It’s got an easy-to-use setup that only needs three bits of info.

- Accurate Results: Relies on exact math to cut down on mistakes.

- Scenario Testing: Lets you try out various mixes of time, amount, and rate.

- Accessibility: You can get to it online or on your phone anytime.

- Transparency: Paints a full picture of what repayments will look like before the money even hits your account.

Private vs Government Bank Variations

Stacking Axis Bank, as a private player, against government-run banks brings out some notable differences:

Private Banks like Axis:

- Quicker to approve loans.

- Heavy on digital features.

- Tailored deals for folks with higher earnings.

- Rates that might be a tad steeper.

Government Banks like SBI or PNB:

- More aggressive on interest rates.

- Involve extra documents and take longer to process.

- Better coverage in countryside areas.

If you’re after fast service and tech ease, private options like Axis often fit the bill, whereas if rock-bottom rates and old-school banking are your thing, public banks might suit better.

Taxation Rules For Axis Bank Car Loan EMI Calculator

In general, car loans don’t give you tax breaks unless the car’s for work purposes.

Personal Car Loan: No deductions for the EMI or the interest part.

Business Car Loan: You can write off the interest as a cost of doing business, which trims down your taxes.

This difference matters a lot for business owners looking to fund cars through their company.

Factors Influencing Axis Bank Car Loan EMI Calculator

A few elements can sway what you end up paying each month:

- Loan Amount: Bigger loans lead to bigger EMIs.

- Interest Rate: A tiny shift, like 0.5%, can shake up the repayments a lot.

- Tenure: More time means smaller EMIs but a heftier interest total.

- Credit Score: Good credit can land you lower rates.

- Down Payment: Putting down more cash upfront lightens the EMI load.

- Type of Vehicle: Fancy or second-hand cars might come with their own rules.

Myths vs Reality

Myth 1: Stretching out the tenure is the way to go. Reality: Sure, EMIs get smaller monthly, but the interest you pay overall skyrockets.

Myth 2: These calculators are just ballpark figures. Reality: They’re super precise and mirror actual payback plans, though they skip tiny fees.

Myth 3: Axis car loans are only for people with regular jobs. Reality: If you’re self-employed or running a business and fit the requirements, you’re in the running too.

Sample Axis Bank Car Loan EMI Calculator Table

Here’s a handy table outlining EMIs for various Axis Bank car loan setups:

| Loan Amount | Tenure (Months) | Interest Rate | Approx EMI |

|---|---|---|---|

| ₹3,00,000 | 36 | 9% | ₹9,542 |

| ₹5,00,000 | 60 | 9.5% | ₹10,497 |

| ₹8,00,000 | 72 | 10% | ₹14,850 |

| ₹12,00,000 | 84 | 10% | ₹19,926 |

| ₹15,00,000 | 84 | 10% | ₹24,908 |

This table shows clearly how tweaking the time or size affects what you owe monthly.

FAQs

Conclusion On Axis Bank Car Loan EMI Calculator

The Axis Bank Car Loan EMI Calculator isn’t merely some gadget for numbers—it’s like a guide leading you to owning a car without regrets. It hands you spot-on EMI figures so you can look ahead, check if it’s doable, and skip any money pitfalls.

With Axis Bank’s solid online setup, adaptable loans, and speedy approvals, it’s a great pick for anyone who likes things convenient. No matter if it’s your initial small car, moving up to a family sedan, or splurging on something upscale, the calculator keeps everything straightforward and in your hands.

If you use it smartly, this tool can help you find that ideal mix of loving your new wheels and keeping your finances on track. Thanks to Axis Bank’s clear-cut policies and this calculator ready to go, hitting the road in your perfect car turns into an easy, worry-free adventure.