How to Calculate Car Loan EMI – Easy & Smart Step-by-Step Guide

What is a Car Loan EMI

A car loan EMI, or Equated Monthly Installment, is basically the set amount you pay each month to settle the loan you took out from a bank or lender to buy your car. This payment covers both the original amount you borrowed, known as the principal, and the interest the lender adds on top.

When you get a car loan, the idea is to pay it back bit by bit over a specific time frame, which could be anywhere from one to seven years. The EMI system makes this process straightforward, so you don’t have to deal with paying everything in one big chunk.

Figuring out how to Calculate Car Loan EMI is really important before you jump into any loan agreement. It has a direct impact on your monthly spending and overall money management. With car prices going up and so many financing choices out there, having a clear idea of your EMI helps you steer clear of unexpected issues and plan your finances more effectively.

Eligibility, Importance, and Benefits

Eligibility for Car Loans

Before we get into the nitty-gritty of EMI calculations, it’s good to understand who can actually get a car loan. Most banks and non-banking financial institutions have pretty similar requirements:

- Age: You need to be at least 21 years old, and no more than 70 by the time the loan ends.

- Employment: You should have a steady job, whether you’re salaried or self-employed.

- Income: You’ll have to show proof that you earn enough to handle the EMIs comfortably.

- Credit Score: A score above 700 is usually what they’re looking for.

Importance of EMI Calculation

Calculating your EMI beforehand is something you shouldn’t skip, and here’s why:

- It gives you a clear picture of your finances before you commit to anything.

- It prevents you from borrowing more than you can handle.

- You can shop around different banks to find the best interest rates.

- It makes it easier to juggle your budget, keeping your expenses in check alongside your loan payments.

Benefits of Knowing EMI in Advance

Being aware of your EMI ahead of time comes with some great perks:

- You won’t face any nasty shocks when repayments kick in.

- It lets you pick a loan term that fits your wallet.

- You gain more leverage when negotiating with lenders, since you know what you can afford.

- It lowers the risk of missing payments, which keeps your credit history in good shape.

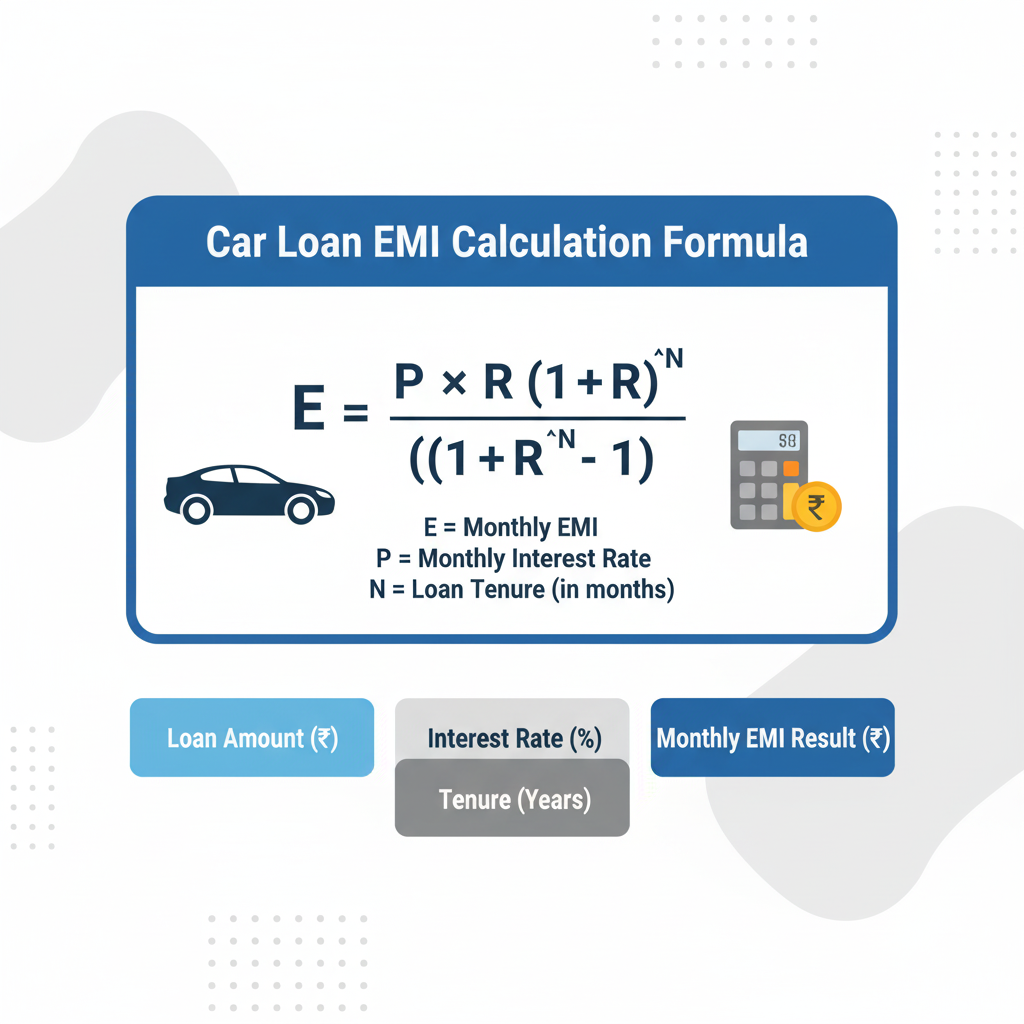

Formula and Calculation Method

The standard way to figure out car loan EMIs uses this formula:

EMI = [P × r × (1 + r)^n] / [(1 + r)^n – 1]

Where:

- P is the principal loan amount, or the actual money you borrowed.

- r is the monthly interest rate, which you get by dividing the annual rate by 12 and then by 100.

- n is the number of months in your loan tenure.

This formula spreads out your repayments evenly over the loan period, so your monthly payments stay consistent and easy to manage.

Examples with Explanation

To make this clearer, let’s look at a few everyday examples of how to calculate car loan EMI.

Example 1 – Small Hatchback Loan

- Loan Amount: ₹4,00,000

- Annual Interest Rate: 8%

- Tenure: 5 years (60 months)

Here, P = ₹4,00,000, r = 0.00667 (that’s 8 divided by 12 divided by 100), and n = 60.

Using the formula, your EMI comes out to about ₹8,114.

Example 2 – Sedan Loan

- Loan Amount: ₹7,50,000

- Interest Rate: 9%

- Tenure: 6 years (72 months)

This works out to an EMI of around ₹13,547.

Example 3 – SUV Loan

- Loan Amount: ₹12,00,000

- Interest Rate: 10%

- Tenure: 7 years (84 months)

Here, the EMI would be approximately ₹19,891.

These examples highlight how tweaking the loan amount, tenure, or interest rate can change what you pay each month.

Maximum Limit or Legal Rules

Typically, banks will cover about 85–90% of the car’s on-road price, but this can shift depending on your personal situation.

General Guidelines

- Minimum Loan Amount: Usually starts at around ₹1,00,000.

- Maximum Loan Amount: This varies based on what you qualify for, often going up to ₹25–50 lakhs for higher-end vehicles.

- Loan Tenure: From 1 to 7 years.

- Collateral: The car you buy serves as the security for the loan.

Legal Compliance

All car loans adhere to the rules set by the Reserve Bank of India (RBI).

If you default on payments, the lender could repossess the car.

Staying on top of your EMIs helps maintain a strong CIBIL score.

Online How to Calculate Car Loan EMI Benefits

Doing the math by hand can be a hassle, which is why most banks and finance sites have online car loan EMI calculators.

The upsides are:

- Instant Results: Just plug in the loan amount, interest rate, and tenure, and you get your EMI right away.

- Transparency: Everything is out in the open, no hidden catches.

- Comparisons: Play around with the numbers to find the best tenure for you.

- Accessibility: You can use them anytime, and they’re free.

- Accuracy: They cut out any mistakes from manual calculations.

Private vs Government / Variations

The EMI calculation formula stays consistent no matter the lender, but the interest rates and terms can differ between private and government banks.

Government Banks (like SBI or PNB): They tend to have lower interest rates and reliable policies, though you might deal with more paperwork.

Private Banks (such as ICICI or HDFC): These offer quicker approvals and more flexible options, but interest rates might be a bit higher.

Your choice boils down to whether you prefer cheaper rates or faster service.

Taxation Rules

Car loans don’t come with the same tax perks as home loans for most people.

For personal use: There’s no tax break on the principal or interest payments.

For business use: You can deduct the interest as an expense, which lowers your taxable income.

This means car loans can feel pricier than home loans unless you’re using the car for work.

Factors Influencing Car Loan EMI

A bunch of things play into how much your EMI ends up being:

- Loan Amount: The more you borrow, the higher your EMI.

- Interest Rate: A small difference, like 0.5%, can make a real impact.

- Loan Tenure: Spreading it out longer means smaller monthly payments, but you’ll pay more interest in total.

- Credit Profile: A solid credit history can get you better terms.

- Down Payment: Putting more money down upfront shrinks the loan size and thus the EMI.

Myths vs Reality

Myth 1: EMI calculators aren’t reliable. Reality: They’re spot-on for estimates; they just don’t factor in extras like processing fees.

Myth 2: A longer tenure always means savings. Reality: Your monthly EMI drops, but the total interest you pay goes way up.

Myth 3: EMI affordability is all about your income. Reality: Lenders also look at your credit score, age, and past payment behavior.

Sample How to Calculate Car Loan EMI Table

Here’s a straightforward table with approximate EMIs for various setups:

| Loan Amount | Tenure (Months) | Interest Rate | Approx EMI |

|---|---|---|---|

| ₹3,00,000 | 36 | 8% | ₹9,400 |

| ₹5,00,000 | 60 | 9% | ₹10,378 |

| ₹8,00,000 | 72 | 9.5% | ₹13,350 |

| ₹12,00,000 | 84 | 10% | ₹19,891 |

| ₹15,00,000 | 84 | 10% | ₹24,864 |

This table illustrates how EMIs increase with bigger loans and higher rates.

FAQs On How to Calculate Car Loan EMI

Conclusion For How to Calculate Car Loan EMI

Getting a handle on how to calculate car loan EMI is key to making smart choices with your money. Whether it’s your first ride or a step up to something fancier, knowing your monthly commitment keeps things stable and stress-free.

The formula might seem a bit intimidating at first, but online calculators simplify everything. By tweaking the loan details, rates, and terms, you can find that sweet spot between what you can afford and what works best.

Ultimately, a car loan should make life easier by getting you on the road, not weigh you down financially. With thoughtful